All Categories

Featured

Table of Contents

A PUAR permits you to "overfund" your insurance coverage plan right approximately line of it becoming a Modified Endowment Contract (MEC). When you use a PUAR, you quickly raise your cash worth (and your survivor benefit), consequently boosting the power of your "bank". Even more, the even more cash worth you have, the better your rate of interest and reward settlements from your insurance coverage company will be.

With the increase of TikTok as an information-sharing platform, monetary guidance and techniques have found a novel method of spreading. One such strategy that has been making the rounds is the limitless banking concept, or IBC for short, amassing recommendations from stars like rapper Waka Flocka Fire. However, while the approach is currently popular, its origins map back to the 1980s when economic expert Nelson Nash introduced it to the world.

How flexible is Self-banking System compared to traditional banking?

Within these plans, the cash worth expands based upon a price set by the insurer (Borrowing against cash value). As soon as a substantial cash money value builds up, insurance holders can acquire a money value financing. These car loans vary from conventional ones, with life insurance policy working as collateral, suggesting one could shed their insurance coverage if loaning excessively without ample cash money value to support the insurance costs

And while the attraction of these policies is apparent, there are inherent limitations and dangers, requiring thorough money worth tracking. The technique's authenticity isn't black and white. For high-net-worth people or company owner, specifically those utilizing methods like company-owned life insurance coverage (COLI), the advantages of tax obligation breaks and substance growth can be appealing.

The allure of infinite banking does not negate its obstacles: Cost: The foundational need, a long-term life insurance policy policy, is more expensive than its term equivalents. Eligibility: Not every person qualifies for entire life insurance policy because of strenuous underwriting procedures that can omit those with particular health and wellness or way of living conditions. Intricacy and threat: The elaborate nature of IBC, combined with its threats, may discourage many, especially when less complex and much less high-risk options are readily available.

What resources do I need to succeed with Borrowing Against Cash Value?

Assigning around 10% of your monthly income to the plan is simply not possible for most individuals. Utilizing life insurance as an investment and liquidity source needs technique and tracking of plan cash worth. Consult a monetary advisor to determine if infinite financial aligns with your concerns. Component of what you read below is just a reiteration of what has already been stated above.

So prior to you obtain into a scenario you're not planned for, understand the following initially: Although the concept is frequently sold because of this, you're not in fact taking a funding from on your own. If that were the instance, you wouldn't need to settle it. Rather, you're obtaining from the insurance firm and have to repay it with passion.

Some social media blog posts suggest utilizing money worth from whole life insurance coverage to pay down credit scores card debt. When you pay back the financing, a portion of that interest goes to the insurance coverage business.

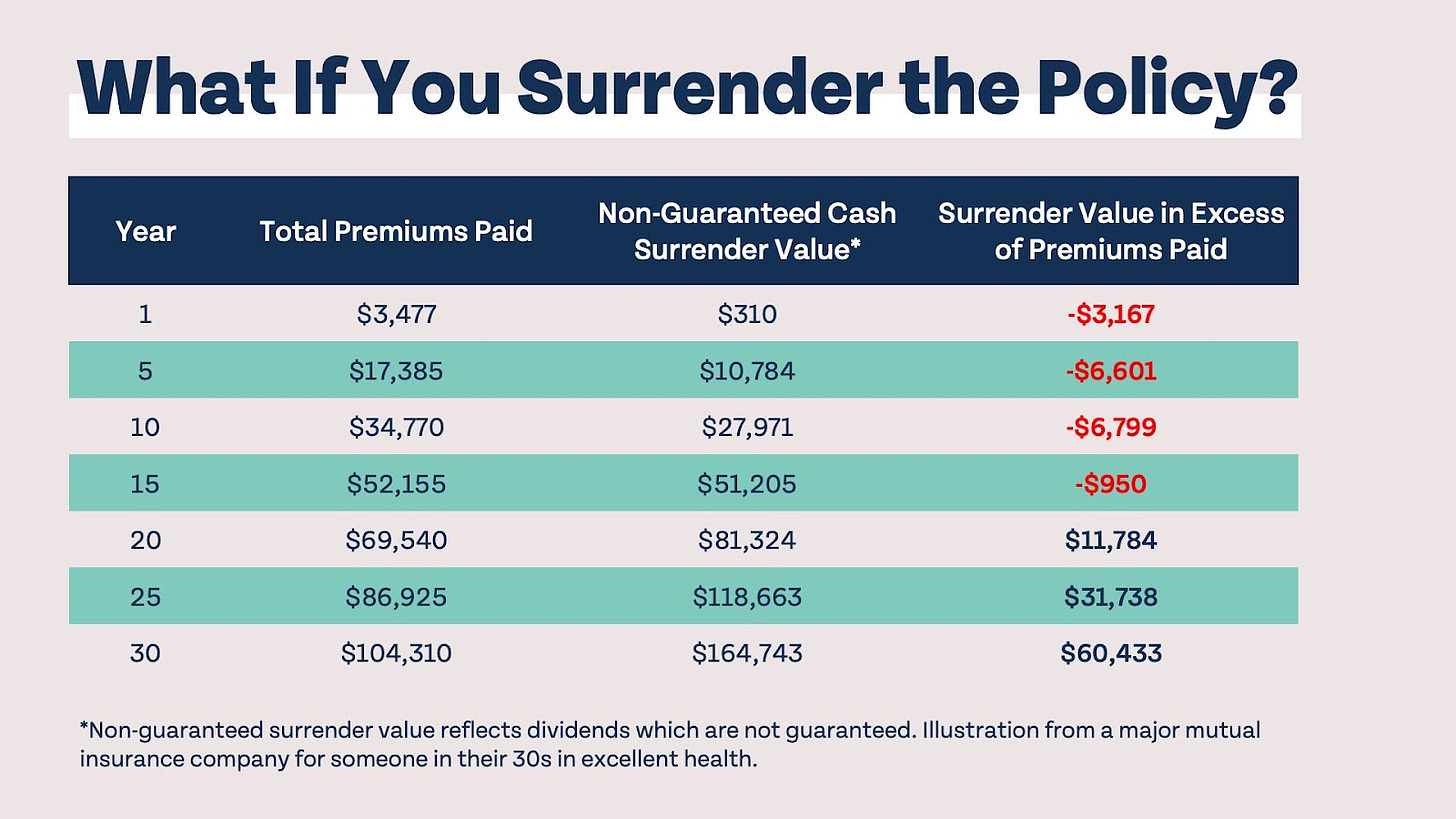

For the first numerous years, you'll be paying off the payment. This makes it exceptionally challenging for your plan to collect value throughout this time around. Entire life insurance policy prices 5 to 15 times much more than term insurance coverage. Most individuals just can't manage it. Unless you can manage to pay a few to several hundred bucks for the next decade or more, IBC won't work for you.

Is there a way to automate Whole Life For Infinite Banking transactions?

If you call for life insurance coverage, below are some beneficial suggestions to think about: Consider term life insurance policy. Make sure to shop around for the ideal rate.

Picture never ever needing to stress over bank fundings or high passion rates again. What if you could borrow cash on your terms and develop riches all at once? That's the power of boundless financial life insurance policy. By leveraging the cash money worth of whole life insurance IUL plans, you can grow your riches and obtain cash without counting on conventional financial institutions.

There's no collection loan term, and you have the liberty to pick the settlement timetable, which can be as leisurely as paying back the loan at the time of fatality. Infinite Banking wealth strategy. This adaptability reaches the servicing of the loans, where you can choose interest-only settlements, maintaining the loan equilibrium flat and convenient

Holding cash in an IUL repaired account being attributed interest can typically be much better than holding the cash money on deposit at a bank.: You have actually constantly dreamed of opening your own pastry shop. You can borrow from your IUL plan to cover the preliminary expenditures of renting out an area, purchasing devices, and hiring staff.

What do I need to get started with Infinite Banking In Life Insurance?

Individual car loans can be gotten from standard financial institutions and debt unions. Obtaining cash on a credit rating card is typically very expensive with annual percentage prices of interest (APR) commonly reaching 20% to 30% or more a year.

Latest Posts

Becoming Your Own Banker Nash

Bank Concept

Bank On Yourself Program