All Categories

Featured

Table of Contents

The approach has its very own benefits, however it also has issues with high costs, intricacy, and more, causing it being considered as a scam by some. Infinite banking is not the very best policy if you need only the investment component. The unlimited financial principle focuses on making use of entire life insurance coverage policies as a monetary device.

A PUAR enables you to "overfund" your insurance policy right as much as line of it becoming a Changed Endowment Contract (MEC). When you use a PUAR, you rapidly boost your cash worth (and your death advantage), consequently enhancing the power of your "financial institution". Further, the more cash money value you have, the greater your passion and reward settlements from your insurer will be.

With the surge of TikTok as an information-sharing platform, financial advice and methods have actually found an unique means of spreading. One such technique that has actually been making the rounds is the limitless banking principle, or IBC for brief, gathering recommendations from stars like rapper Waka Flocka Fire - Generational wealth with Infinite Banking. However, while the method is presently popular, its roots map back to the 1980s when economic expert Nelson Nash presented it to the world.

Is Infinite Banking For Retirement a good strategy for generational wealth?

Within these policies, the money worth grows based upon a rate set by the insurer. Once a substantial cash money worth builds up, policyholders can acquire a cash worth car loan. These finances vary from conventional ones, with life insurance policy serving as collateral, indicating one can shed their protection if borrowing excessively without sufficient cash worth to support the insurance prices.

And while the attraction of these policies appears, there are inherent limitations and threats, necessitating persistent money value surveillance. The method's legitimacy isn't black and white. For high-net-worth individuals or company owner, specifically those using techniques like company-owned life insurance (COLI), the advantages of tax obligation breaks and substance growth might be appealing.

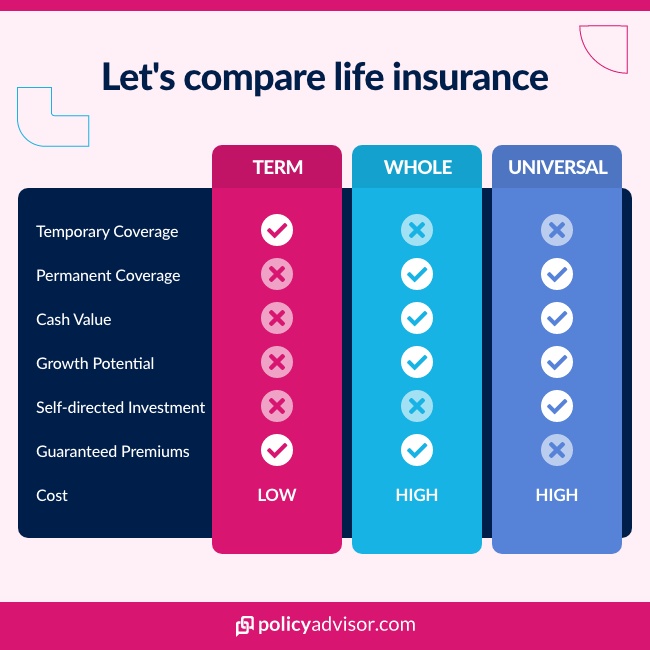

The attraction of limitless financial doesn't negate its difficulties: Expense: The foundational requirement, a long-term life insurance policy policy, is costlier than its term equivalents. Eligibility: Not every person receives entire life insurance policy due to strenuous underwriting procedures that can omit those with certain health and wellness or way of life conditions. Complexity and danger: The intricate nature of IBC, combined with its risks, might deter lots of, particularly when less complex and less high-risk choices are readily available.

Can I use Privatized Banking System to fund large purchases?

Alloting around 10% of your monthly earnings to the plan is simply not possible for lots of people. Making use of life insurance coverage as a financial investment and liquidity resource calls for discipline and tracking of plan cash worth. Get in touch with a financial consultant to figure out if boundless banking lines up with your concerns. Component of what you review below is merely a reiteration of what has actually already been stated over.

So before you obtain into a circumstance you're not prepared for, know the following first: Although the idea is generally marketed as such, you're not in fact taking a loan from on your own. If that held true, you would not have to repay it. Rather, you're borrowing from the insurance provider and have to settle it with interest.

Some social networks posts advise making use of cash worth from whole life insurance policy to pay for credit history card financial debt. The idea is that when you pay off the finance with rate of interest, the quantity will be sent back to your investments. Sadly, that's not how it functions. When you pay back the funding, a portion of that interest mosts likely to the insurer.

Leverage Life Insurance

For the very first numerous years, you'll be repaying the compensation. This makes it incredibly difficult for your policy to collect value during this time. Entire life insurance policy costs 5 to 15 times extra than term insurance. Most individuals merely can not manage it. So, unless you can manage to pay a few to numerous hundred dollars for the following years or more, IBC will not help you.

Not every person ought to count exclusively on themselves for monetary safety. Leverage life insurance. If you require life insurance coverage, below are some important suggestions to think about: Take into consideration term life insurance policy. These policies supply protection throughout years with considerable financial commitments, like home mortgages, pupil fundings, or when caring for young children. Ensure to go shopping around for the finest price.

How do I optimize my cash flow with Infinite Banking Wealth Strategy?

Think of never having to fret regarding financial institution fundings or high interest rates once more. That's the power of limitless financial life insurance.

There's no set car loan term, and you have the freedom to decide on the settlement routine, which can be as leisurely as paying back the loan at the time of death. This adaptability encompasses the maintenance of the financings, where you can go with interest-only payments, keeping the lending equilibrium flat and convenient.

What are the benefits of using Infinite Banking Retirement Strategy for personal financing?

Holding money in an IUL taken care of account being credited rate of interest can frequently be far better than holding the cash money on down payment at a bank.: You've constantly dreamed of opening your very own bakeshop. You can borrow from your IUL plan to cover the initial costs of leasing an area, acquiring devices, and employing team.

Individual financings can be gotten from traditional financial institutions and cooperative credit union. Right here are some bottom lines to consider. Credit scores cards can offer an adaptable way to obtain money for extremely short-term durations. Borrowing cash on a debt card is usually extremely expensive with yearly portion prices of interest (APR) commonly reaching 20% to 30% or more a year.

Table of Contents

Latest Posts

Nelson Nash Scam

Becoming Your Own Banker Nash

Bank Concept

More

Latest Posts

Nelson Nash Scam

Becoming Your Own Banker Nash

Bank Concept