All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance plan right as much as line of it becoming a Modified Endowment Contract (MEC). When you utilize a PUAR, you rapidly boost your cash money worth (and your death advantage), thereby enhancing the power of your "financial institution". Additionally, the even more money worth you have, the better your interest and returns repayments from your insurance business will certainly be.

With the increase of TikTok as an information-sharing platform, financial guidance and strategies have actually found an unique method of spreading. One such method that has actually been making the rounds is the unlimited financial idea, or IBC for brief, garnering recommendations from celebrities like rapper Waka Flocka Fire. However, while the method is currently preferred, its origins trace back to the 1980s when economist Nelson Nash introduced it to the world.

What are the most successful uses of Infinite Banking Account Setup?

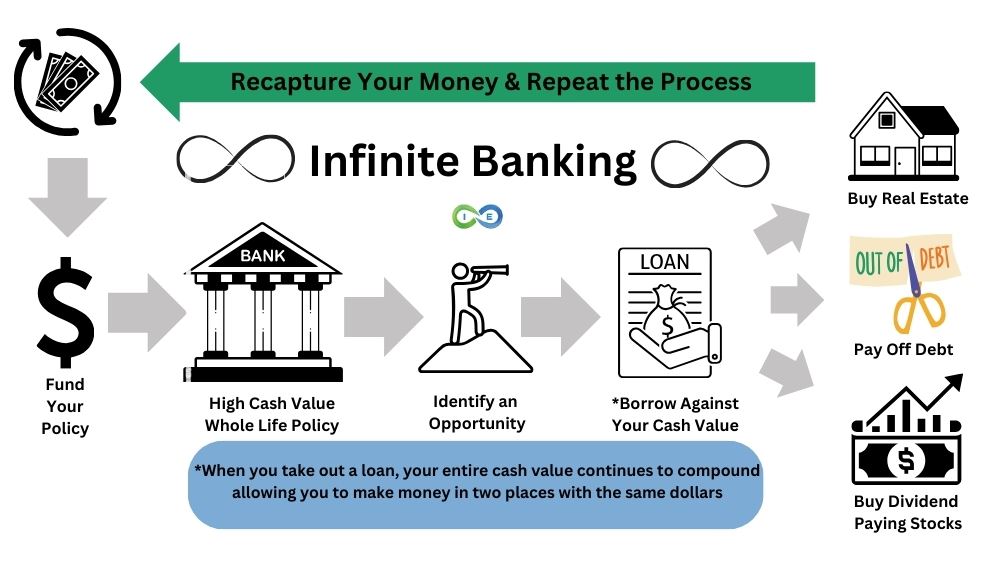

Within these plans, the money value grows based on a price set by the insurer (Infinite Banking). As soon as a considerable money value collects, insurance policy holders can obtain a cash value finance. These loans vary from conventional ones, with life insurance policy acting as security, indicating one could shed their protection if borrowing excessively without appropriate cash value to support the insurance expenses

And while the attraction of these policies appears, there are inherent limitations and threats, requiring diligent cash money value monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or entrepreneur, especially those making use of strategies like company-owned life insurance (COLI), the benefits of tax obligation breaks and substance growth could be appealing.

The appeal of limitless financial doesn't negate its obstacles: Price: The foundational requirement, a permanent life insurance policy plan, is costlier than its term equivalents. Qualification: Not everyone qualifies for entire life insurance policy because of extensive underwriting processes that can exclude those with specific health and wellness or lifestyle problems. Complexity and risk: The detailed nature of IBC, combined with its risks, might deter lots of, especially when easier and much less risky alternatives are available.

What are the tax advantages of Infinite Banking Vs Traditional Banking?

Assigning around 10% of your regular monthly revenue to the policy is just not possible for the majority of people. Making use of life insurance policy as a financial investment and liquidity resource requires self-control and monitoring of plan money value. Get in touch with a financial expert to identify if infinite banking straightens with your priorities. Part of what you review below is just a reiteration of what has actually currently been claimed above.

So before you obtain right into a scenario you're not prepared for, recognize the following first: Although the idea is frequently sold therefore, you're not in fact taking a financing from yourself. If that held true, you would not need to repay it. Rather, you're borrowing from the insurer and need to repay it with interest.

Some social media posts advise making use of cash worth from entire life insurance policy to pay down charge card debt. The concept is that when you settle the loan with passion, the quantity will certainly be sent out back to your investments. That's not how it functions. When you repay the finance, a section of that interest mosts likely to the insurance provider.

For the first several years, you'll be settling the commission. This makes it exceptionally tough for your policy to collect value throughout this time around. Entire life insurance expenses 5 to 15 times a lot more than term insurance policy. Many people merely can not afford it. Unless you can pay for to pay a couple of to several hundred dollars for the following years or even more, IBC will not work for you.

What financial goals can I achieve with Cash Flow Banking?

Not everyone must count entirely on themselves for economic protection. If you need life insurance policy, below are some beneficial tips to think about: Think about term life insurance. These plans provide protection during years with considerable economic obligations, like home mortgages, student lendings, or when taking care of little ones. Make sure to go shopping around for the very best rate.

Imagine never having to stress regarding financial institution lendings or high rate of interest rates once more. That's the power of unlimited financial life insurance policy.

There's no collection loan term, and you have the freedom to pick the repayment schedule, which can be as leisurely as paying back the car loan at the time of fatality. Financial independence through Infinite Banking. This versatility includes the maintenance of the loans, where you can select interest-only settlements, maintaining the funding equilibrium level and convenient

Holding money in an IUL fixed account being attributed passion can often be far better than holding the cash money on down payment at a bank.: You have actually constantly imagined opening your own pastry shop. You can obtain from your IUL policy to cover the initial expenses of renting a room, purchasing equipment, and hiring personnel.

How long does it take to see returns from Cash Flow Banking?

Personal finances can be obtained from conventional banks and cooperative credit union. Below are some key factors to consider. Bank card can offer a flexible way to borrow money for really short-term durations. Obtaining money on a credit scores card is typically extremely costly with annual percentage prices of rate of interest (APR) commonly reaching 20% to 30% or even more a year.

Latest Posts

Nelson Nash Scam

Becoming Your Own Banker Nash

Bank Concept