All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance plan right as much as line of it becoming a Customized Endowment Contract (MEC). When you make use of a PUAR, you swiftly increase your cash worth (and your fatality advantage), consequently boosting the power of your "bank". Further, the more cash money worth you have, the better your rate of interest and dividend repayments from your insurance provider will be.

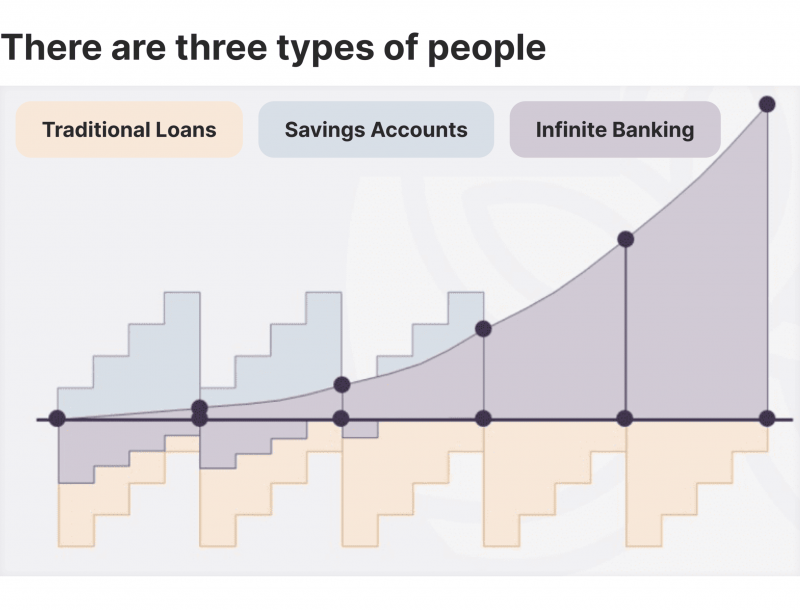

With the surge of TikTok as an information-sharing system, economic recommendations and techniques have actually located an unique method of dispersing. One such strategy that has been making the rounds is the boundless financial idea, or IBC for brief, gathering recommendations from celebrities like rapper Waka Flocka Flame. While the method is currently popular, its origins map back to the 1980s when economic expert Nelson Nash introduced it to the globe.

How do I track my growth with Infinite Banking For Financial Freedom?

Within these plans, the money value grows based upon a rate set by the insurer (Infinite wealth strategy). When a significant money value collects, policyholders can obtain a cash worth car loan. These financings differ from conventional ones, with life insurance functioning as security, indicating one could shed their insurance coverage if loaning excessively without sufficient cash worth to sustain the insurance policy costs

And while the allure of these policies is noticeable, there are innate restrictions and risks, necessitating diligent cash money worth monitoring. The method's authenticity isn't black and white. For high-net-worth individuals or entrepreneur, particularly those making use of techniques like company-owned life insurance policy (COLI), the advantages of tax breaks and substance growth can be appealing.

The appeal of limitless financial does not negate its obstacles: Expense: The fundamental need, an irreversible life insurance policy policy, is pricier than its term equivalents. Qualification: Not every person gets approved for whole life insurance policy as a result of rigorous underwriting procedures that can leave out those with details health or way of life problems. Complexity and risk: The elaborate nature of IBC, coupled with its threats, might hinder many, especially when simpler and much less high-risk choices are available.

How long does it take to see returns from Infinite Banking Concept?

Assigning around 10% of your regular monthly earnings to the policy is just not possible for most individuals. Component of what you read below is just a reiteration of what has already been said above.

So prior to you obtain yourself right into a scenario you're not gotten ready for, recognize the adhering to first: Although the concept is frequently sold thus, you're not actually taking a lending from yourself. If that held true, you wouldn't need to settle it. Rather, you're obtaining from the insurance policy company and have to repay it with interest.

Some social media messages recommend utilizing cash value from entire life insurance to pay down credit report card financial debt. When you pay back the funding, a portion of that rate of interest goes to the insurance policy company.

For the initial a number of years, you'll be paying off the compensation. This makes it incredibly difficult for your policy to accumulate value during this time. Unless you can pay for to pay a few to several hundred dollars for the following decade or even more, IBC will not work for you.

Can I use Borrowing Against Cash Value to fund large purchases?

Not everybody ought to depend only on themselves for financial safety. If you require life insurance policy, below are some beneficial tips to take into consideration: Think about term life insurance policy. These plans supply coverage throughout years with significant economic responsibilities, like home mortgages, student fundings, or when taking care of young kids. See to it to search for the ideal price.

Imagine never having to worry regarding financial institution financings or high interest prices once more. That's the power of boundless financial life insurance policy.

There's no collection funding term, and you have the flexibility to pick the repayment routine, which can be as leisurely as settling the lending at the time of fatality. Infinite Banking for retirement. This adaptability includes the servicing of the lendings, where you can go with interest-only settlements, keeping the financing balance level and convenient

Holding cash in an IUL dealt with account being credited passion can commonly be far better than holding the cash on deposit at a bank.: You have actually constantly desired for opening your own bakery. You can obtain from your IUL policy to cover the first expenditures of leasing a room, purchasing tools, and employing personnel.

What are the most successful uses of Generational Wealth With Infinite Banking?

Personal loans can be obtained from typical financial institutions and credit scores unions. Obtaining cash on a credit card is usually really pricey with annual percent rates of rate of interest (APR) typically getting to 20% to 30% or more a year.

Table of Contents

Latest Posts

Nelson Nash Scam

Becoming Your Own Banker Nash

Bank Concept

More

Latest Posts

Nelson Nash Scam

Becoming Your Own Banker Nash

Bank Concept